By Nate Berg

From entry-level interns to top-tier management, the business of architecture relies on smart workers [staff]. To stay competitive and endure an ever-turbulent job market, design firms need to recruit the best and the brightest while holding on to the skilled talent they already have.

Look for Inquisitive Minds

When seeking new talent, New York–based Robert A.M. Stern Architects partner Graham Wyatt, AIA, says firms should look broadly at the candidates’ talents. Architectural ability and design skills are obviously important, but they shouldn’t be the only factors considered. “Look for people who are broadly educated and, beyond that, people who are inquisitive about the world, who are not just one-dimensional,” he says.

Incentive High Performance

Rewarding employees based on the quality of their work will push them to excel and make them feel appreciated. Robert A.M. Stern Architects uses a system as part of a profit-sharing model that, when the firm is in the black, issues an additional bonus to employees based on annual reviews. “The principle of it is important to the culture of our firm, which is to reward people at all levels so they feel that they’re pulling in the same direction,” Wyatt says, “and that’s really essential to our success.”

Respond to Shifts in Supply and Demand

The layoffs during the recession may seem like fresh wounds, but the market has recovered. Demand for architects is high now due to increased work and a limited supply of professionals. “Twenty to 30 percent of the architectural workforce left in the last recession, so the talent pool is much smaller,” says David McFadden, CEO of Consulting for Architects, a staffing agency. Firms need to recognize that it’s a seller’s market. “Architects are just not sitting on a department store shelf anymore.”

Evaluate Routinely

Regular performance reviews are crucial for employers to track progress and for workers to get positive feedback, constructive criticism, and, ideally, a chance to request a raise. Communication is mutually beneficial, but it sometimes doesn’t happen enough. “In some firms, the annual review only happens every two or three years,” says Herbert Cannon, president of consultancy AEC Management Solutions. “That can be demoralizing to employees.”

Be Less Picky, Hire More Quickly

A dearth of architects means employers need to adjust expectations and perhaps lower their hiring standards. The perfect candidate simply might not exist. “There’s still this perception that there’s people available that meet all of your criteria. But in fact there’s not and so you need to make a quick attitude adjustment,” says McFadden. To top it off, the limited supply is in such demand—the candidates you want may be under consideration by other firms. McFadden suggests acting quickly: “Shorten the time from receiving a résumé to scheduling an interview to making an offer. … You have to be quick; otherwise you’re going to lose out to a firm that is.”

Honor Loyalty

Firms need to know how to hold on to what they’ve got. That was easier during the recession when many architects were happy to have any job. But now that things have turned around and opportunities are opening up, employers need to do more to keep their workers from perusing the job boards. McFadden says firms should increase compensation for the people who stuck with them during the recession, and even more so for those who saw years pass by without a raise.

by Nate Berg for Architectmagazine.com*

*This article was not written for The CFA Blog. This article was written for Architect Magazine.com and reposted by CFA for the CFA Blog.

Editors note: Obviously, we contributed to this article, and agree with the points Nate makes. Do you agree that the hiring trend favors the applicants?

Search Careers

Request Talent

Join Mailing List

Architecture Hiring

|

AIA NY, American Institute of Architects, Architect, architects, architecture, Architecture billings index, business, Consulting For Architects, David McFadden, Hiring Demand, jobs, RAMSA, recession, Rewarding Employees, Robert A.M. Stern Architects, Salary Increase, Staff, Staff Retention, unemployed architects

|

Employers Ask. They All Got Jobs.

6 Crucial Ways to Repopulate Your Workforce

Introduction

Unemployment rates are still uncomfortably high across the nation, there is a misperception that architectural talent must be plentiful, but for specific experience, the exact opposite is true. The shortage is so acute that it has been associated with a rise in offshoring, a bidding war and comparisons to college recruiting. To secure the architecture talent they need, hiring managers must adopt a competitive hiring strategy or lose to someone who does.

Architects had to get even more creative after the economic recession that began around December 2007. The built-in versatility from their studies in areas such as civil engineering, math, art history, and physics positioned them well for thinking outside the box. Jumping ahead seven years, the demand for architectural talent in the wake of the recession has re-stabilized, but talent availability lags behind. No hiring firm could have possibly predicted this rapid shift. To remedy the imbalance between supply and demand, hiring firms must shift their perception of what is viable and consider potential candidates on more realistic criteria.

Supply and Demand

Within the last 10 years, supply and demand in the architecture industry have moved in opposite directions. Uncertainty about capital access discouraged building development, leading to dormant projects and a lack of ambition in both the commercial and residential markets. In 2012, a study by Georgetown University revealed that architecture graduates had experienced the highest rate of unemployment (13.9%) when compared to other fields. Prior to the recession, this problem was not nearly so pronounced.

The Recession’s Effect

The poor economy challenged architects to get creative. According to the Department of Labor, 39,900 jobs were lost in 2010 alone. Architects were forced to think flexibly in order to sustain a livelihood and many did. For example, take 26-year-old architect Natasha Case: she was laid off from a prestigious position at Walt Disney Imagineering. Within a year, Case developed a homemade mobile ice cream business with a friend. Flavors were inspired by architecture. One such flavor was the “Frank Behry,” named after renowned architect Frank Gehry. The startup was such a hit that Case’s former employer, Walt Disney Imagineering, became a customer.

Case is not the only person who resorted to new endeavors during the recession. After years of uncertainty, architects have settled into new careers both in and outside of the industry, leaving the talent pool depleted.

Demand is Rapidly Growing

As the architecture industry attempts to bounce back from economic instability, the landscape has changed significantly. According to MNI News, hiring firms in New York, Los Angeles, and North Carolina report explosive growth; the American Institute of Architects released a billing index in August 2014, showing its highest growth rate since 2007. There are no signs of this pattern slowing.

Industry spending is projected to increase by 10 percent for non-residential construction in 2015. Kermit Baker, chief economist at the American Association of Architects, attributes this growth to more capital access and recovering business confidence.

Institutional projects, which were sluggish in early 2014, are generating growth as well, with public, private and charter school projects popping up in New York City, Long Island, and beyond. Better access to capital has allowed for the renewal of projects that were once dormant, and for the launching of new ones. The Housing Studio, an 18-year-old firm in Charlotte, North Carolina, is billing at its highest rates.

According to the Federal Reserve’s economic forecast, growth is expected to rise 3 percent in the second half of 2014, followed by another 3 percent in 2015. At the same time, the national unemployment rate is projected to fall to 5.5 percent in 2015. Design projects are regenerating, demand snowballing nationally, and architectural demand outpaces supply.

The Talent Pool

Like Natasha Case, many architects have scattered into new industries since the recession. Architecture graduates have been forced out of the field due to a lack of opportunities and inadequate levels of experience.As many hiring firms know, several factors must fall into place for talent to be hired for a project. Candidates are expected, at a minimum, to be proficient in design software, have at least three to seven years of experience in a specific type of work, be eligible to work in the U.S, and be a good cultural fit. The rise in both residential and commercial design projects in 2014 qualified architects, who are still in the talent pool, simply cannot meet the demand.

On top of this, federal and state laws provide a slew of other obstacles for hiring firms to secure the right candidates. Even small firms must comply with the requirements laid out by the Affordable Care Act and the Department of Labor and Homeland Security. Further complications arise when determining exempt vs. nonexempt employees, contractors and overtime eligibility. Considering this myriad of complications, it is no surprise that firms are experiencing an imbalance of supply and demand.Aside from this, cultural changes have caused Millennials to leave their firms after an average of just three years. This puts an extra layer of pressure on firms to continuously cycle through the recruitment process. Retention levels have dipped due to this shift toward a freelance-style career.

In combination, these factors lead to significant stress and a continuous lack of stability at firms, who must constantly process recruitment materials and decide on new candidates. A simple attitude adjustment by hiring firms is necessary for the industry to regain its economic footing. This does not refer to a lowering of standards but rather an expansion in considerations during the hiring process.

In Order to Compete for Quality Talent, Hiring Firms Must Be More Flexible in 6 Crucial Areas:

1. Experiential Requirements

Considering the sluggish pace at which design projects progressed in recent years, newer architects were unable to acquire extensive experience in various areas. With larger commercial projects handed off to established architects, those with less experience are continuously overlooked.

2. Cultural Fit

While a person’s character and their ability to mesh with current company values are important, the decision to hire should primarily be determined by the candidate’s ability to execute the design. Assessing perfect cultural fit is generally a matter of opinion, best made flexible during times of talent shortages.

3. Compensation

Considering the level of competition currently face by hiring firms who are in need of talent, flexibility in compensation is crucial. Approaching candidates confidently with a reasonable figure will motivate them and assure them that they are in the right place.

4. Hiring Time

Architects are at an advantage as the industry currently stands. When the correct candidate is found, hiring firms should work to reduce the time between the initial meeting, and the extension of an offer; under lengthier circumstances, architects may move on to other available firms.

5. Employment Duration

While it may be frustrating for both firms and architects to be floating in a sea of uncertainty, this post-recession period of adjustment are unavoidable. It’s worth considering a candidate regardless of the amount of time he or she plans to stay with a firm, and the training time required.

6. Project Placement

In a talent shortage such as this, it may not be feasible to have every employee working as a full-time staff member. While it may sound like a hassle, temporary employees can provide the extra energy burst needed to push a project beyond original expectations. These employees could also serve as a more objective third party with unique backgrounds and perspectives while stabilizing the peaks and valleys associated with architectural practice.

Conclusion

As projects slowly resume and capital becomes available, a full recovery from the recession is in sight. The final puzzle piece involves architects being reacquainted with hiring firms. At least a few decades will pass before for the talent pool can catch up with demand. With many senior architects out of the game for good, and waves of graduates who’ve yet to mature, this problem won’t diminish anytime soon.In order to bridge the gap, hiring firms must be willing to adapt. If the above changes are implemented, hiring firms will be better able to thrive in the industry’s current climate.

Search Careers

Request Talent

Join Mailing List

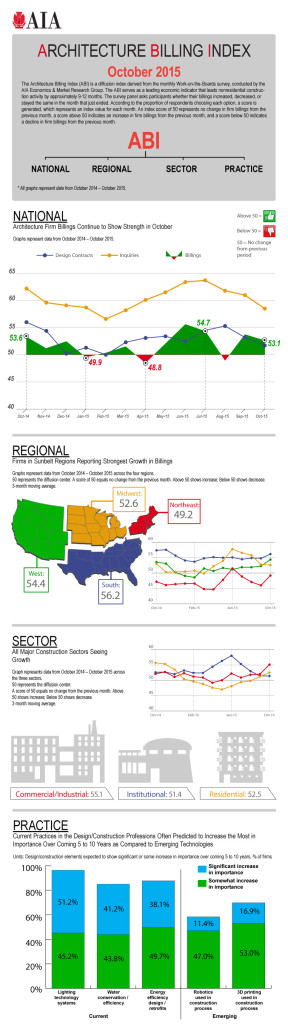

Firms Report Strongest Billing Since Before Recession

PHILADELPHIA (MNI) – U.S. architects are enjoying the fastest growth in billings since before the recession for their work on a range of residential and commercial construction projects, and expect continued growth in coming months, according to company owners and a trade association.

Architecture firms in Los Angeles, New York, and Charlotte, North Carolina said they have hired more people in recent months and expect to hire again to cope with the extra demand from developers of apartment buildings, retail space and in some cases institutional properties like charter schools.

While some companies have at least doubled their billing and the size of their payrolls since the depths of the recession, most said they have work in the pipeline that suggests even stronger revenue in 2015.

“This is really just getting underway,” said Kermit Baker, chief economist at the American Association of Architects, in an interview. “We are very much in the early innings of what looks to be a healthy recovery.”

The AIA’s monthly index of billing, which in July showed its strongest growth since mid-2007, is expected to show continued strength when the August index is released on Sept. 24, Baker said.

“I don’t think there’s any evidence that August was off that trend line significantly,” he said.

The industry has seen intermittent growth during the last three or four years so the evidence of a sustained upturn is not yet conclusive but the current increase is the strongest since the recession, Baker said.

The growth suggests there will be an upturn in non-residential construction spending of around 10% in 2015, Baker said. He attributes the upswing to improving business confidence and better access to capital.

“Businesses are finally at a stage where they are comfortable reinvesting in their facilities, and comfortable that the economic upturn is going to be sustained,” he said. “They are seeing sufficient demand to justify reinvestment.”

The greater availability of financing is allowing the restart of construction projects that stalled several years ago because of a tight credit environment after the recession.

“Financing has begun to ease up a little bit,” Baker said. “Surprisingly strong numbers of firms are saying they are now working on projects that they had begun three or four years ago, but stopped work and now they have come back.”

Even the market for design of institutions such as schools is coming back after a period when it was hurt by a decline in local government tax revenue.

“The last couple of months we have seen very strong numbers on the institutional side, which would suggest that construction activity moving into 2015 will begin to pick up,” Baker said.

The higher demand for institutional work has been seen in New York City where Caples Jefferson Architects is designing schools for both public and private-sector clients, as well as undertaking more work on residential projects.

“There are lots and lots of charter school construction going on right now as well as public construction,” said Sara Caples, president and principal of the firm in Long Island City.

Caples said demand for her firm’s services is at its strongest for at least five years, and that billing in the last few months has been about double its level of a year earlier. And in a sign that billings will growth further, she said she has had a “flood” of requests for proposals in recent months, and is responding to an unusually large number of them.

“We throw out a lot of requests for proposals if we don’t think we have a strong chance, and we’re still putting out a major proposal every week or so, which is just extraordinary,” she said.

Current projects include a 20,000 square-foot charter school in the Bronx, and a 40,000 square-foot charter school plus a 12-unit residential component in Manhattan, she said.

Residential developments are facilitating the construction of associated institutional projects because of the strong retail market in New York, Caples said.

“The market is strong enough that the residential makes it viable to build the six-story school on quite a challenging site,” she said. “The 12 residential units will allow them to pay off the mortgage very rapidly. The residential market seems to be the little engine that’s financing quite a lot of things.”

The eight-person firm already is two architects bigger than it was at the start of 2014, and may add more, despite an extremely selective hiring policy, if it takes on just one or two projects, she said.

The growth is being fueled by easier access to finance, which is helping not only to revive dormant projects but to launch new ones, Caples added.

“That’s what’s different about this,” she said. ‘Now, people are actually making new deals with their financiers that haven’t been kicking around forever.”

And she said her firm’s current growth seems to be representative of the market as a whole. “Most of the people that we talk to seem to be experiencing similar patterns,” she said.

In Charlotte, North Carolina, The Housing Studio, an architecture firm specializing in multi-family housing projects around the East Coast between Philadelphia and Charlotte, and in the Denver, Colorado area, is seeing an “explosion” in growth, said President Chuck Travis.

He said the company is billing about $3 million annually or more than three times the level during the recession. Its 28-strong work force is now about twice its traditional size, and four times its level at the low point of the recession. Travis said he’s looking to hire four or five more architects.

Travis said the growth is unprecedented in the company’s 18-year history. “It’s exponential growth in a two-year time frame,” he said.

He attributed the upswing to increased demand for rental housing in the walkable or transit-oriented urban areas that are favored by the “millennial” workers who eagerly sought by developers across the country.

That sector of the population is less interested in housing as an investment than was the previous generation, and prefers the flexibility of rented accommodation, he said, predicting continued growth.

“We’re not showing any signs of slowing down,” he said.

The demand for downtown living is also being seen in a three-square-mile area of Los Angeles, where 6,000 residential units are under construction and another 14,000-16,000 units are being planned, according to Simon Ha, a partner with TSK Architects.

That is creating more work for firms like TSK which is billing 30% more than it did a year ago, and has hired four architects this year for a total of 10, Ha said. And demand is stronger than it was in the pre-recession years of 2006-2007.

The construction boom, which he said is being fueled by investment from China, has resulted in land prices in the downtown area jumping to around $400 a square foot from $250-$300 two years ago. Land near LA’s Staples Center is now selling for about $600 a square foot, or about double its level two years ago, he said.

With a booming population of single people demanding housing in previously desolate urban areas like downtown LA, there are big opportunities for companies like TSK which has increased its billing for residential design to 70% of its total, Ha said.

By JON HURDLE, August 2014.

Search Careers

Request Talent

Join Mailing List